Welcome to the latest issue of HX Legacy.

As some of you may know, it has been a couple of months since our last report. We last published with our Quarterly Review back in December. Our last new pick was our recommendation of Robinhood Markets, Inc. (NASDAQ: HOOD) in late October 2024.

Those of you familiar with your previous long-term investing publication – Empire Elite Growth – are likely used to us publishing on a more regular basis.

To start this issue, we wanted to reiterate that we are taking a different approach with HX Legacy.

We have set the bar very high on the quality of the ideas we want to recommend. As a result, we will only publish a new recommendation when we feel we have an OUTSTANDING one.

If that means we publish only a handful of ideas per year – so be it!

The idea is quality versus quantity.

So far, we think we are doing pretty well with the strategy. Here is a quick overview of our recommendations and their performance…

In aggregate, we have strongly outperformed the S&P 500 and all the other major indices since we began publishing a year ago.

Our ideas have returned an average +37.5% return on invested capital while investing in the S&P 500 on an apples-to-apples basis would have produced a +14.2% return. Not too bad!

Our selectivity has also helped us as our most recent recommendations – Vistra Corp. (NYSE: VST) and HOOD are both up more than 100% in less than six months. This is why we are selective.

We only want to publish if we have GREAT ideas. Like the one we have today.

Let’s also remember what our goals with HX Legacy are…

This publication aims to identify stocks (and occasionally other securities) where we can produce at least a +100% return over an intermediate (three-year) period.

That is the "floor" of what we are looking for, but we are – of course – aiming much higher. Our goal is to have several positions that can be multi-baggers over time.

However, one critical aspect of this strategy is that we are focused on capital preservation.

While we would love to see several multi-baggers in the portfolio over time, we will work hard to avoid any material (-35%) destruction of capital.

We look at the base goal as a "three-to-one" risk/reward. We only put out ideas we think can double, but we will work hard to avoid losing more than a third of the original investment in any position.

Across our thirty years of long-term investing, we think this is the "sweet spot" of risk/reward.

The portfolio also takes an eclectic approach regarding the "style" of investment we recommend.

Many of our ideas would fall into "growth" investments. The stock will likely follow if a company can grow revenue and earnings by two, three, five, or ten times.

We also are focused on another group of ideas around asset value.

This is not necessarily a traditional value approach of "paying $0.10 for $1" of assets. Instead, it is identifying assets where we are paying $1, but we are confident that the asset value will be $2, $5, or even $10 in the future.

Most of these ideas are genuinely unique franchises that cannot be replicated. This has been a particular area of focus in our career.

Despite its long-term focus, we are also more willing to trade around positions in this strategy.

You can revisit the HX Legacy Primer here for a lengthier overview of our strategy.

Now, let’s jump into our new idea…

In This Issue:

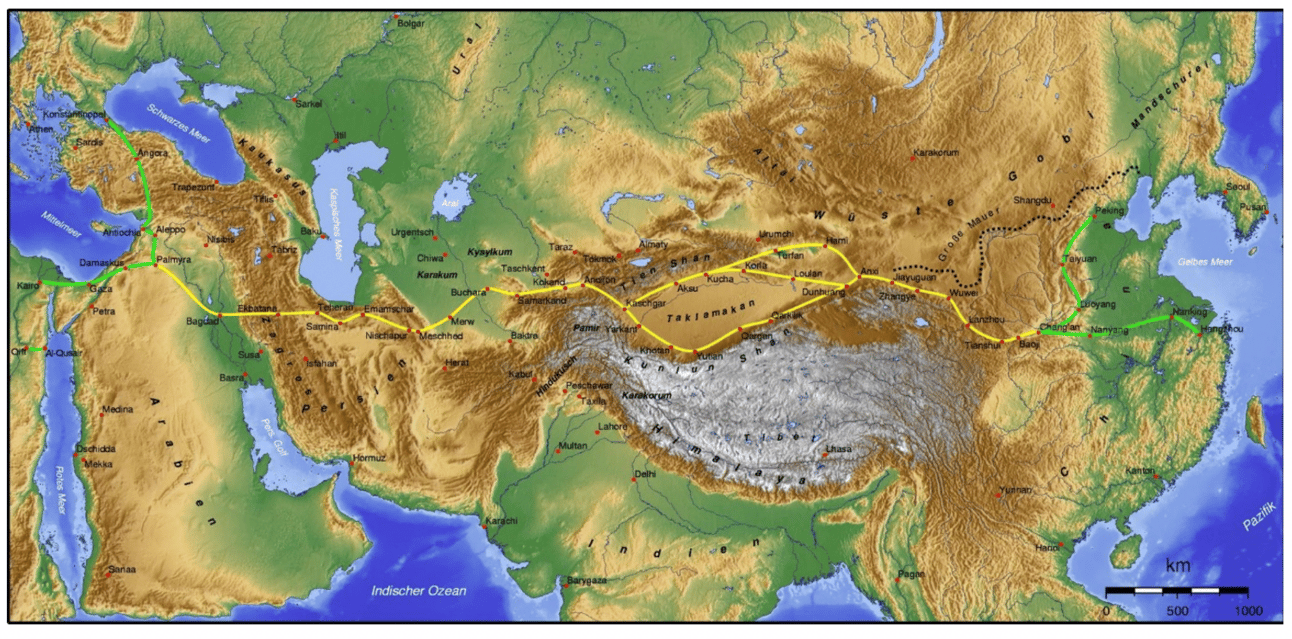

The Silk Road

One can trace much of the development of modern civilization back to the dramatic expansion of trade that occurred two thousand years ago.

This explosion in trade began when the Han Dynasty in China officially opened trade with the rest of the world in 130 BCE.

There certainly was global trade before that time, but the connection between the East and the West's major cultures really began the rise in the development of modern civilization.

The story of the Silk Road began when Han Emperor Wu sent imperial envoy Zhang Qian out to contact Central Asian peoples. This then led to the opening of further trade routes even further West all the way to Europe.

Source: Wikipedia

There actually had been a previous major trade route built in Persia several hundred years before the opening of the Silk Road. This was called The Royal Road and would eventually connect to the Silk Road and bring it to the West.

The Silk Road included an extensive network of strategically located trading posts, markets, and roadways that facilitated goods' transport, exchange, distribution, and storage. It eventually would stretch over 4000 miles and the entire expanse of Asia, the Middle East, and parts of Europe.

While silk transport is most closely identified with this trade route, it was used for all types of other goods. Many of these goods would transform the world around them.

For instance, both paper and gunpowder were invented by the Han Dynasty Chinese and would forever change the world. They also would be key to the future industrialization of the West.

It would also have significant political and historical consequences with major events like the Black Death and the Mongol conquests.

In addition to trade, the Silk Road was also vital in exchanging knowledge between the great powers of the East and West. Famed Venetian explorer Marco Polo used it to travel from Italy to China and eventually meet Mongolian emperor Kublai Khan.

More important than even the goods exchanged over the Silk Road, the IDEAS that would travel along this route would change human history.

The Silk Road would be the dominant pathway for the communication of civilizations until the Fifteenth century when the Western nations would master the seas. It is fair to say that it was the primary driver of human advancement for the better part of 1500 years.

Keep On Truckin’

The oceans would dominate the expansion of human trade and civilization for the next five hundred years. In the last half-century, though, another mode of transportation has become the primary driver of economic expansion in major economies.

That is the trucking industry.

Before the invention of automobiles, most freight moved by train or horse-drawn vehicle.

Trucks were first extensively used during World War I. In the United States, it was only after the war that we began to see the expansion of paved roadways. This expansion allowed this new technology (trucks) to play a role in the movement of goods. The invention of the (much more efficient) diesel engine in 1920 also advanced the growth of trucking.

The ability to move freight by truck expanded dramatically in the post-World War II period as the United States engaged in the build-out of the Interstate Highway System. President Franklin Delano Roosevelt had proposed this idea, but the war delayed its construction.

It wasn’t until the Federal-Aid Highway Act was approved in 1956 that we began to see the dramatic expansion of the highway system in the United States.

The next twenty years saw a dramatic expansion in the highway system and the development of a robust and diverse trucking ecosystem.

Those of you who are old enough will remember the emergence of "trucker culture" in the 1970s. Independent truck owners and operators took advantage of the emerging opportunity, and they became the modern version of cowboys in America.

Songs about trucking topped the charts, and several movies dominated the domestic box office. Who can forget classics like Convoy, Every Which Way but Loose, and – my favorite – the television series BJ and the Bear?

That was the TV show where an independent trucker named Billy Joe "B.J." McKay traveled the highways in a red and white Kenworth K100 cabover with a chimpanzee sidekick "Bear" named after famed Alabama football coach Bear Bryant…

We can’t make this up!

Trucking played a huge role in my life.

My father had become a Teamster in the Denver area to help support our family in the mid-1970s. Off the back of that affiliation, he eventually became an independent trucker himself.

He never had enough money to own a truck but would drive for other owners.

After my parents divorced, I would often spend summers with my father trucking across America. Here is a picture of my father and myself from the late 1970s…

(Please note the fine black velvet oil painting of a white stallion hung on the wood paneling of our trailer!)

He operated as what was known as a “wildcatter.” This is a trucker who would not have all the proper tags and registration for every state he would truck through and would use the backroads to avoid having to pay the fees.

Without having to pay for these registrations, he could offer lower prices and go out and get loads to run across the country. My father was literally an OUTLAW trucker.

A vast network of independent drivers dominated the trucking industry during that period. The business allowed many blue-collar individuals to become entrepreneurs and make a great living for their families.

In the United States, the industry underwent deregulation in the early 1980s, and the industry began to consolidate around larger operators. Independent truckers played a far more minor role and are the minority in the US today.

As much as the trucking industry played an important cultural role in America in the last 20th century, most people don't recognize how important it was to our economic development.

Our extensive network of highways and roadways, combined with the flexibility allowed by trucks, has created a remarkable and efficient distribution system. It has helped supercharge our economic growth and bring a broad range of goods at attractive prices nationwide.

America would not be the economic superpower it is today without the success of the trucking industry.

The Fast Follower - China

While the United States has continued to see tremendous economic growth in the last half-century, the global story has been about the development of the Chinese economy.

Whatever your opinion of China on the geo-political scene, the economic growth since the 1970s has been one of the most significant advances in human history.

Below is a graphic showing how Chinese GDP has grown from roughly $250 billion in the early 1970s to over $16 trillion by 2019. Today, it stands at more than $18 trillion.

This level of growth at this scale is unlike anything we have ever seen before on Earth.

One way that China has achieved this growth is by being what is called in economics a "fast follower."

This means that Chinese economic growth has not been driven solely by innovation in their economy but also by taking advantage of innovations seen elsewhere. They have quickly followed trends set by others, refined them, and scaled them efficiently.

Being a "fast follower" has helped supercharge Chinese growth.

One of these areas of development in China has been in their system of highways and roadways. Similar to what the United States did in the 1950s through the 1970s, China has embarked on an ambitious effort to build out a system of roads.

Geographically, China and the United States are similar in size at 9.6 million square kilometers and 9.8 million square kilometers, respectively. China is well set up to benefit from a highway system – and trucking industry – in a very similar manner to the United States.

The growth in the Chinese road system has been awe-inspiring in the last ten years. As of 2023, China has a road network of over 5.2 million kilometers, making it the largest in the world. Almost half of that has been built just in the last decade!

This has also led to massive growth in the Chinese trucking industry.

Estimates are that there are between 20 million and 30 million truck drivers in China today and that they handle 70% of the freight traffic in the country. This is in stark contrast to the United States, where the percentage of freight traffic is similar, but there are less than 4 million truck drivers.

China has seen colossal roadway growth, but the trucking industry resembles the United States in the 1970s. Right now, 80% of their truck drivers are independent.

China has been a fast follower in building out freight trucking, but it has many opportunities to become more efficient.

Another area where China has been a “fast follower” is on the INTERNET.

The Internet was introduced to China in 1989 but became widely available in 1994, albeit with heavily censored access.

China has been in a unique position regarding its ability to roll out internet accessibility because it did not have robust legacy telecom networks like the US or Europe. This allowed them to build new networks that would be very efficient.

They also didn't get started until the start of this century, so they could skip the early days of the Internet and skip straight to the era of the established technologies.

Think of it as they were able to skip the Yahoo and AOL era and go straight to the Facebook, Google, and Amazon period.

By 2008, China had already become the country with the largest population of internet users and continues to be so today with over 1 billion users. Almost 20% of global internet users in the world are Chinese.

China is unique in that the Chinese government owns online access routes. There is no private ownership of the Chinese network, and the major telecommunications companies can only lease capacity.

This unique structure, along with the Chinese government's preoccupation with having Chinese companies dominate their market, has led to China developing its own unique set of internet companies.

We mentioned some of the major US-based companies like Facebook and Google above, but they are not allowed to operate in China. Instead, there is a host of Chinese champions who dominate the industry.

You may have heard of a few of these companies, as many are publicly traded on US stock exchanges. Here is a graphic showing many of them…

While none of these are of the same scale as the US companies, they are huge. Tencent has a market capitalization of over $600 billion and Alibaba over $350 billion.

While they may have been "fast followers" to build their network and initial technology, Chinese companies have become leaders in digital innovation today.

They have taken advantage of their late start and focused on building more integrated solutions.

While US companies dominate the global Internet, many major global digital innovations come from Chinese companies.

As a successful fast follower in the trucking industry and the Internet, China brings us to this month's HX Legacy idea…

A $1 Trillion Opportunity

The company is the New York Stock Exchange-listed Chinese digital freight and logistics platform Full Truck Alliance Co. Ltd. (NYSE: YMM).

This Guiyang, Guizhou-based company was created by the 2017 merger of two previous digital freight platforms – Yunmanman and Houchebang. Those were founded in 2013 and 2011, respectively.

The stock trades as American Depositary Shares (ADSs) and went public in June 2021.

Here is a slide showing a history of the company…

The company runs a digital platform connecting shippers – including large companies, shipping brokers, and small-medium enterprises (SMEs) – with China's 30 million truck drivers.

Here is a slide from their most recent investor presentation mapping their platform…

Some have called it the “Uber” of Chinese freight and logistics. It is a decent analogy.

As we mentioned previously, the Chinese trucking industry is highly fragmented, with 70% of drivers operating independently.

The shippers are also very fragmented.

China has large shippers like the United States, but the system of shipping brokers is much more fragmented. The US system developed over the last 70 years, but two decades ago, there were barely any highways in China.

There is also a large ecosystem of smaller shippers (SMEs) that number over 30 million.

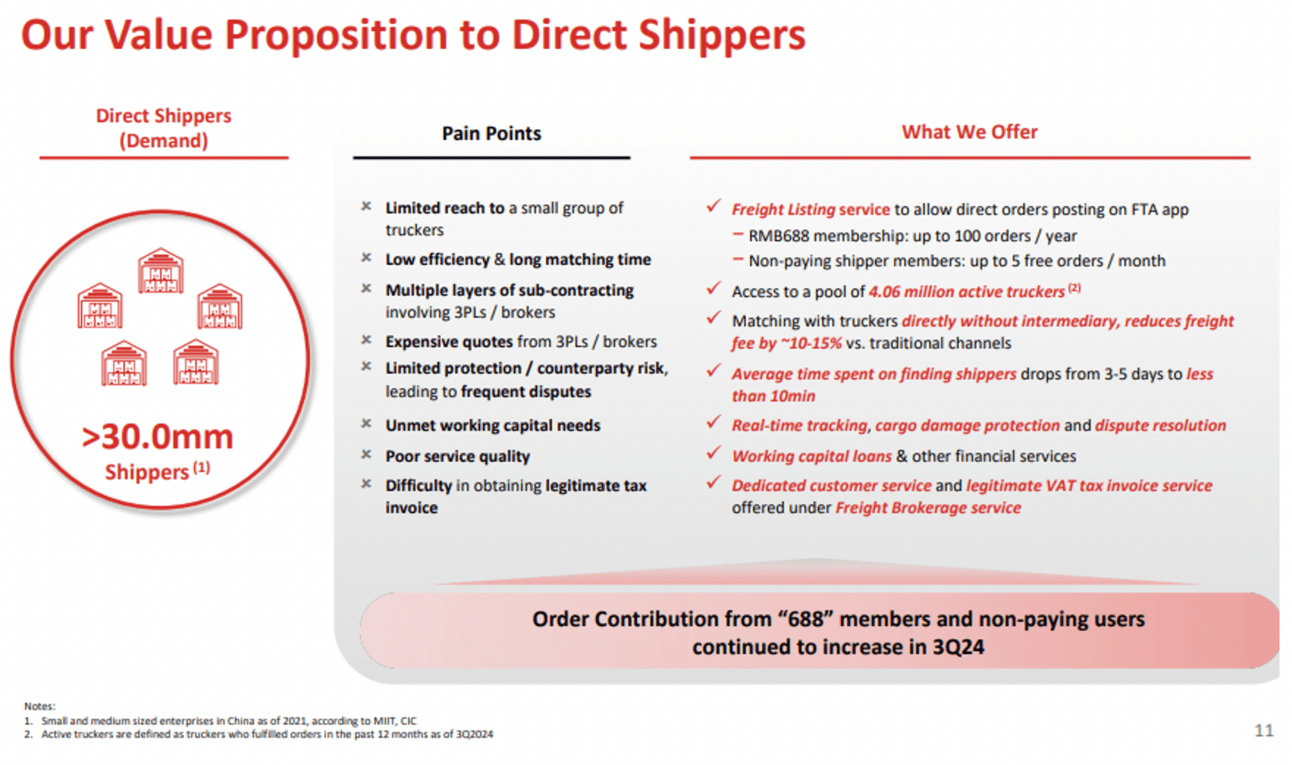

The company's investor presentation lays out its value proposition to three main constituencies – Direct Shippers, 3PLs (Third Party Logistics operators), and Brokers and Truckers.

Here are those slides…

Going back twenty years, the process for truckers and shippers to connect was manual. They would both go to a local truck stop, and there would be (literally) a blackboard where shippers would write down what they were looking to do. Then, individual truckers would offer their services and bid to take the shipments.

The predecessor companies to YMM went through an arduous process of going to every one of those thousands of locations and digitizing the process. This took them the better part of a decade.

It is a considerable barrier to entry as many of those physical locations no longer exist. If a new entrant wanted to build the same network, it would be costly and take a long time.

At this point, the company has a 65% digital freight market market share. They arguably have a competitive position that would be impossible to replicate. The company is exceptionally well positioned.

Their target market is also desirable in terms of the opportunity.

Estimates show that only about 10% to 15% of the total freight in China is scheduled on a digital freight platform.

A recent survey of truckers from Renmin University of China demonstrates the potential need for digital freight services.

In the survey, 63% of truckers spend 3-8 days, and 22% spend more than 9 days to find cargo. This compares to TEN MINUTES on a digital platform!

Once truckers have loads, 59% have more than 24 hours of empty backhaul, and 46% think a digital platform would help.

Amongst truckers, 80% don’t have pre-booked orders; when they do, it is almost exclusively on the outbound journey.

This huge market has very low penetration, and YMM has a huge network and market share. This is a tremendous opportunity.

Doing the Math

Since going public in 2021, the company has begun to get a good handle on its operations as a publicly traded entity.

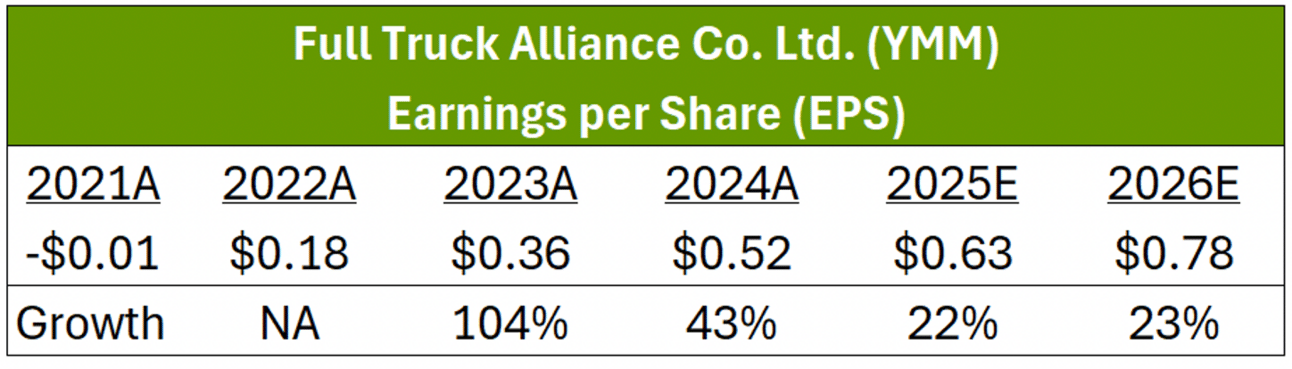

First, the company has managed to post good earnings growth.

Here is a table showing their annual earnings per share or “EPS” since coming public and estimates for the next few years…

The company has gone from breakeven to good profitability with solid double-digit growth rates. We think the eventual growth rates could be as much as two or three times higher than current estimates.

Remember that earnings growth is the key to stocks going much higher. At the end of this report, we are going to lay out the case on how the EPS for the stock could be as much as $3 to $5 per share.

As they have established themselves, they have also put together a good track record of beating analyst's expectations. This table shows their results versus analysts' expectations since they have come public…

Their first quarter as a public company was “noisy,” but since then, they have beaten every other quarter.

This is an essential factor for a stock to work—shareholders like to own companies that are beating numbers.

It shows good momentum in the business and that the company has a good handle on its business.

Beating estimates consistently leads to analysts having to raise their numbers. This creates positive earnings revisions, the most significant short-term driver of stock performance.

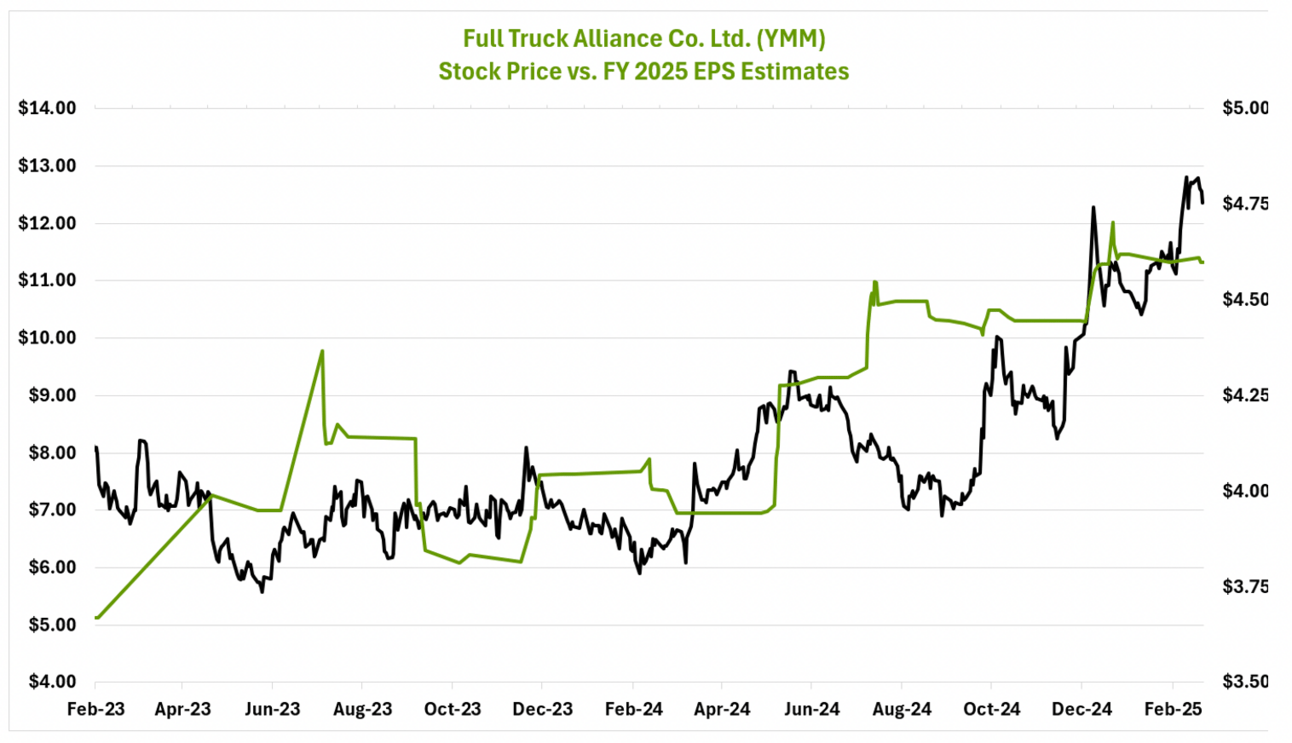

Here is a chart showing the stock price along with the analyst estimates for 2025 EPS. Note this chart is quoting the EPS in Chinese RMB…

Estimates have been consistently moving higher, and the stock is moving higher. We think the stock will continue to follow if they continue to move higher.

Again, we want to own stocks with positive earnings revisions.

Even if our primary focus is on the overall growth in earnings (EPS), we want to own companies that are beating numbers and seeing rising estimates. This shows us that the "promise" is there with the company and that they are executing.

Ultimately, the only variable we REALLY want to focus on is earnings growth.

Companies that grow earnings from $1 to $10 will ALWAYS go up. They may go up a little, they may go up a lot. They may go up sooner or later. However, they ALWAYS go up.

We like YMM because we think it has the potential to go from the current $0.52 in 2024 EPS to $3 to $5 EPS in the next few years.

We will lay out our case below, but IF that happens, we think the stock has a three to five times upside. THIS is the kind of idea that we are looking at for HX Legacy.

Why do we think they could grow EPS this much?

Here is our case…

Competitive Moat – With a 65% market share of digital freight and a network that took over a decade to build, we do not think they will be displaced competitively. They could even grow market share, but we model them just keeping it stable.

Customer Growth – The company right now does business with almost 3 million shippers and 4 million truckers. In the SME market alone, there are 30 million shippers, and the company is targeting 10 million. We think their number of customers could double or triple from current levels.

Take Rates – This is the percentage commission they take on the shipper bill. Right now, the company takes 1.6% of the value of the transaction. This is up from 0.6% back in Q1 2021.

This compares to the legacy brokers, which charge between 10% to 15%.

The company thinks that eventually, they will be able to take the take rate to 2%-3% or double it from current levels. We believe it could go even higher. This means that their current revenue could almost double. We agree with the company.

It is not an exact comparison, but ride-hailing applications take an 18% to 30% commission. There is a LOT of room for them to increase pricing.

Commission Rates – The company builds market share with a “freemium” model. Right now, they are getting paid on 81% of their orders, up from 52% of them back in Q1 2022. They cover 300 cities but only charge for 234 of them. The company believes that in the long term, they should get to 100%. We agree.

Penetration of TAM – With digital freight platforms being used on 10% to 12% of total transactions and YMM's market share, they are getting roughly 6% of their "total addressable market" or TAM. We think digital freight platform penetration could double or triple current levels.

We are NOT factoring in any growth in the Chinese freight market in this list. Realistically, it is likely to grow, and most analysts have it growing in mid- to high-single digits over the next five years.

That will help, but we don't think the company needs it all. They have grown strong double digits recently, even with the Chinese economy doing poorly and the freight market struggling.

Unlike our time on Wall Street, we don’t write long reports going through minutiae. We focus on the ONLY variable that counts – EARNINGS GROWTH.

Here is a summary of our thesis…

Today, the company earnings are $0.52

Market Share = Stable

Customer Growth = 2x to 3x

Take Rate Growth = 2x to 3x

Commission Rates = +20%

Penetration of TAM = 2x to 3x

We have THREE separate major variables that we think could grow a multiple of where they are right now.

Remember this for REVENUE growth.

Given the operating leverage of their digital online model, the contribution margin of incremental revenues will be much higher.

Right now, the estimate for 2028 by analysts is $1.17 or +125% from current levels. If the company hits that number, we think the stock will at least double or triple.

IF, however, we are correct about our analysis above, then that number could be $2, $3, or even $5. If THAT happens, we could be looking at a five- to ten-bagger with YMM stock.

ACTION TO TAKE: We recommend that readers buy a 5% position in shares of Full Truck Alliance Co. Ltd. (NYSE: YMM) up to $20 per share.