Welcome to the third Quarterly Review of the recommendations for our INVESTING publication, HX Legacy.

For this publication, we publish a thorough review of all outstanding positions and anything closed during the previous three months every three months (after reporting seasons).

This publication aims to identify stocks (and occasionally other securities) where we can produce at least a +100% return over an intermediate (three-year) period.

That is the "floor" of what we are looking for, but we are – of course – aiming much higher. Our goal is to have several positions that can be multi-baggers over time.

However, one critical aspect of this strategy is that we are focused on capital preservation.

While we would love to see several multi-baggers in the portfolio over time, we will work hard to avoid any material (-35%) destruction of capital.

We look at the base goal as a "three-to-one" risk/reward. We only put out ideas we think can double, but we will work hard to avoid losing more than a third of the original investment in any position.

Across our thirty years of long-term investing, we think this is the "sweet spot" of risk/reward.

The portfolio also takes an eclectic approach regarding the "style" of investment we recommend.

Many of our ideas would fall into "growth" investments. The stock will likely follow if a company can grow revenue and earnings by two, three, five, or ten times.

We also are focused on another group of ideas around asset value.

This is not necessarily a traditional value approach of "paying $0.10 for $1" of assets. Instead, it is identifying assets where we are paying $1, but we are confident that the asset value will be $2, $5, or even $10 in the future.

Most of these ideas are genuinely unique franchises that cannot be replicated. This has been a particular area of focus in our career.

You can revisit the HX Legacy Primer here for a lengthier overview of our strategy.

In this update, we also have a small incremental BUY recommendation.

We tactically add to or subtract from positions when we see opportunities.

Right now, we see an outstanding opportunity in one of our stocks with the most upside. We want to take advantage of it!

Here is the current portfolio of ideas sorted by recommendation date:

From a return perspective, the group of recommendations is doing very well with some big winners.

On an annualized and adjusted basis, they would be up approximately +30% versus the S&P 500 +14% over the same period. This is GREAT performance!

We will review the positions in chronological order.

Taboola.com Ltd. (NASDAQ: TBLA) – Reference Date 2/2/24 – Return -20%

What does the company do?

TBLA is a digital advertising platform that allows advertisers to access the "open web." This is the internet outside the "walled gardens" of the social media giants like Google and Facebook. Think of it as a way for advertisers to access millions of websites through a single platform.

Why do we like it?

Growth.

The company has built significant scale and proprietary technology (they have been investing in artificial intelligence for real for years) that allows them to attack a market that has $80 billion of ad spend per year and grows double digits. The "open web" makes up 2/3rds of web traffic but only gets 30% of digital ad spend. TBLA is the solution.

In late 2022, the company entered into a 30-year service agreement with Yahoo, which is still the 12th largest website in the world. They are building out infrastructure to service this massive amount of traffic, which will drive significant growth and should have high visibility.

These are the analyst expectations for revenue and EBITDA…

IF you believe the company can hit these numbers, it trades at only about 5x EV/EBITDA and 7x EPS for an internet market leader. Other internet leaders like Pinterest, Inc. (NASDAQ: PINS) and Snap Inc. (NASDAQ: SNAP) trade at more than triple (or more) those valuation levels.

IF the company hits these numbers, the stock will go a LOT higher.

How is the company doing?

This has been our most challenging position since we started, but we have stuck with it because of the tremendous potential. It is among the highest potential upside positions in our recommendations.

Since we last updated you in August, the company has been doing "better." We were frustrated with the results in August, but their most recent report was one of the best of the year.

Since we initiated our position, they have reported earnings three times: February 28, May 8, August 7, and November 7.

Here are the tables of how they are doing versus estimates for revenue and EBITDA…

The "good" news is that they beat on revenue this most recent quarter. Not by much, but they still beat the number. This has been an issue because the company has seen negative revisions on the top line.

They did not beat the EBITDA number by much, but it was still better than expected.

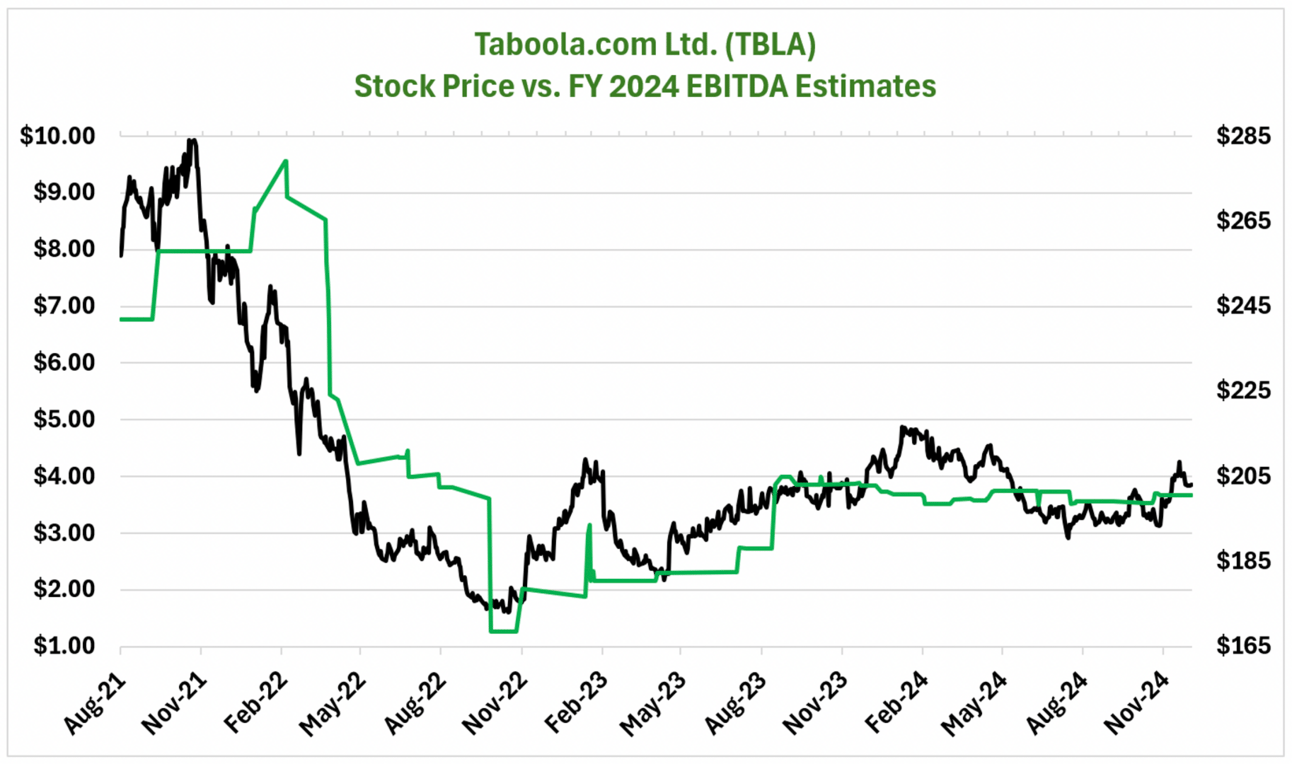

This improvement is evident when you look at the charts showing the analysts’ 2024 estimates for revenue and EBITDA.

Here are those charts…

In our last update, the revenue estimates had fallen by -10%. Since then, they have not gone up but have been stable. The EBITDA estimates have also gone up slightly.

Our view is simple – if the company can keep up the absolute growth and profitability growth, it will ultimately drive the stock in the intermediate and long term.

If they can also get to a point where they see stable to higher revisions, the stock will begin to REALLY work. The revisions don't have to be significant; they just can't be negative.

As we have explained in the past, the company is making a considerable investment to ramp up its business with Yahoo. This has taken longer than expected, but they are getting a handle on it. This is a substantial multi-year deal; this is a logical explanation.

We are encouraged by progress in revisions but will continue to monitor what happens with the upcoming quarter as it is a big one seasonally. We won’t say it is a full “make-or-break” quarter, but it is a very important one.

How is the stock doing?

Not great but better than where it had been at our last update.

In our previous notes, we mentioned that our entry point could have been better, as the stock ramped up +10% in the two days before we launched. Ultimately, though, we are playing for the stock to double, triple, or go even higher, so it shouldn't matter.

The challenge for the stock has been the downward revisions. Those have ceased now, and the stock has recovered some from the depths of our loss.

As we said in our last note, despite the loss, we still like the position. With this kind of upside, we will suffer through an initial loss for a while.

What is our overall view?

Our view is identical to last update, and this is what we wrote then…

“We still like the position, but we are monitoring it closely.

As we said above, the absolute profitability growth will ultimately drive the stock.

One of two things is going to happen.

One scenario is that the analysts' revenue estimates eventually fall in line, and profitability growth is realized. If this happens, we think the stock has a massive upside.

Another scenario is that revenue growth continues to slip, eventually impacting their profitability. If that happens, we will sell the stock.

Do we have confidence that they will hit the numbers?

We do. The business plan and the setup make sense, and their explanation for the slippage in revenue estimates is also logical.

One last aspect that comforts us is that this is a cheap stock with a good balance sheet. They are profitable, generating free cash flow and buying back stock. We think this limits the downside in the shares unless the numbers completely fall apart.

Given this last aspect, the risk versus reward on the shares is incredible, and we continue to like the position.

As we said, we will closely monitor the operating results.”

Nothing has changed, except they are now closer to the first scenario. That is a good sign, but this next quarter will tell us a lot!

Atlanta Braves Holdings, Inc (NASDAQ: BATRK) – Reference Date 2/2/24 – Return -5%

What does the company do?

They own the Major League Baseball team, the Atlanta Braves. They also won the real estate development around their ballpark called "The Battery."

Why do we like it?

Asset Value.

This is VERY different than the position we discussed above.

Owning professional sports franchises is one of the best risk/reward opportunities we have seen in our thirty-year investing career.

No franchise has sold below the prior sale price in half a century. Very few (20%?) have sold around the estimated value; the rest have sold at +20% to +300% premiums.

The principal owner of the Braves – Liberty Media – is now in a taxation position where they can sell the team and minimize taxes. The team is also one of the most talented in the Major Leagues.

We don't know when they will sell it (although we think it will be in the next few years) and at what price (although we believe it will be +20% to +100% from current levels), but this is a spectacular risk/reward.

How is the company doing?

Fine. This is a VERY different type of investment than almost any other stock we recommend.

Investors pay almost no attention to the revenue and earnings.

They have reported three times since we launched - February 28, May 8, August 8, and November 6.

Only three analysts cover the stock, so the company has no detailed estimates. However, all three quarterly results have been satisfactory.

The financial results are irrelevant to the thesis if no disastrous event exists. The team had a fine but uneventful season.

The most interesting data point for the stock is sports team valuations.

There have not been any major data points in team sales or valuations since the last update. We have continued to see some very strong TV deals globally. We will talk more about that later in this report.

We remain VERY comfortable with owning the Atlanta Braves.

How is the stock doing?

We are down (-5%) from our entry point.

We expect this stock to trade in a +/- 15% range until one day we wake up and make +50% or more.

What is our overall view?

We LOVE this idea. These sports franchises are the best risk/rewards we have ever seen in our careers.

We have a full 5% position but would add aggressively on any market-related weakness.

Talen Energy Corporation (NASDAQ: TLN) – Reference Date 2/16/24 – Return +206%

What does the company do?

Talen is an "Independent Power Producer" or "IPP" that owns and operates 12.7 Twh of generation capacity, including the sixth-largest nuclear power plant in the United States, Susquehanna. Essentially, it produces and sells electricity to utilities and other industrial users.

Why do we like it?

Asset Value and Growth.

TLN owns one of the rarest assets on Earth—a large, functioning, clean-energy nuclear power plant.

The company's total value (equity + debt) today is around $11.5 billion

from an asset value perspective.

When they built their nuclear power plant in the 1970s, it cost $8 billion in inflation-adjusted dollars, which would be $24 billion today.

Large utility company The Southern Company (NYSE: SO) just finished adding two new nuclear reactors at a cost of more than $30 billion. These two units have a combined 2.43 MW of nameplate capacity compared to the 2.23 MW of TLN’ Susquehanna operation.

This is not a very "liquid" market, but the value of the nuclear plant alone is MUCH higher than the company's current $8 billion value.

In terms of growth, the company is on track to do $780 million in EBITDA.

However, power generation growth in the US is minimal, and demand is accelerating because of the heavy electricity requirements of the data crunching necessary for artificial intelligence.

The company recently made a deal with Amazon, where they sold their power at $70 Mwh. This compares to the $45 Mwh where it trades in their market. If their total capacity would eventually sell at that $70 Mwh, they would do almost $1.2 billion of EBITDA or +50% from current levels.

Look at it this way: Southern could bid DOUBLE the current share price of TLNE and acquire nuclear capacity at a 50% discount on what they just paid. Instead of waiting two decades, they would have it in less than a year.

This is still our BEST idea!

You can read our reports below:

How is the company doing?

Great! The company reported on November 14 and continued to report great numbers.

The company has done almost everything we thought it could do (and more), and you can read about all of that in the updates above.

The company raised the low end of its EBITDA and free cash flow guidance while raising its 2025 forecast.

The stock had some volatility during the last few months as a request by Amazon to expand their “behind the meter" deal was denied by regulators. This happened in November and created much volatility in the stock.

TLN operates in a highly regulated business with many regulatory intricacies that recent investors do not understand well. The good thing for our readers is that we have been following this group for three decades and are well-prepared.

It was (and is) our view that even if the expansion of the "behind the meter" deal were denied, the economics for TLN would not change. Amazon would pay more for the power to make up the difference, as they would STILL be getting the power cheap.

Within a few days, the stock recovered and continued its rally to new highs.

The company also bought back more stock during the last few months and more than 20% of the shares in the past year. They still have a remaining authorization for over $1 billion, which could buy back another 10% of the shares at these prices.

Look at our most recent update from back in September (above), and we lay out the case of how they might back up to 50% or more of the shares from here in the next few years.

We think that in Q1 of 2025, we will see another strong quarter. We also believe that the company and its peers will continue to announce more deals like the Amazon deal, which will help the stock.

Finally, there was also an auction in their region (PJM) that was delayed in Q4 that will happen in the 1st half of 2025, and this will be another positive catalyst.

We are entering what we still think is the second inning of a power Supercycle like we saw in the late 1990s.

We remain very comfortable with the business and the operating upside.

How is the stock doing?

In our August update, we wrote "CRUSHING IT!" and it looks like we WAY underestimated!

Since our original recommendation on February 16, the stock has been up a remarkable +206%. That makes it one of the top stocks in the US stock market during this period.

Initially, we were so excited that we initiated it at a larger-than-normal position size (7.5%).

We sold some of our position (2.5%) after the stock rocketed +28% in just a few weeks. That looks like a lousy sale, but it complies with our long-established trading disciplines.

What is our overall view?

In August, we wrote – "We think the stock has a +25% to +50% upside before the end of the year. Looking out further, we believe it can DOUBLE from current levels.”

That is precisely what it did!

Looking into 2025, we think the stock has an upside of $250 to $300. There is also a significant probability that another company will come in and offer to buy the entire company at over $300 per share.

IF we see any material weakness in the position again, we will add to it.

Sphere Entertainment Co. (NYSE: SPHR) – Reference Date 3/26/24 – Return -13%

What does the company do?

The company owns one of Earth's most unique entertainment venues – The Sphere in Las Vegas, Nevada. It is a 16,000-seat venue with the most advanced video and audio technology ever constructed to create a unique entertainment experience.

They also own considerable intellectual property rights in the concept and can roll it out (and license) globally.

They also own other assets, including the cable television network MSG Networks and a large London real estate holding.

Why do we like it?

Growth and Asset Value.

After the project was initially announced in 2018 with a target opening date of 2021, The Sphere finally opened in late 2023. The final construction cost was over $2.3 billion, almost double the original estimate.

The situation with the existing cable TV business is quite complicated. Still, we believe they will eventually exit the cable business without materially impacting the company's value, which is currently approximately $1.5 billion.

That is a 35% discount on building this unique asset. Building the same asset today would cost much more, and accordingly, we see the venue's asset value as at least two times or more than the company's current value.

With the venue only having three quarters of operations so far, we also think that analysts have underestimated the venue's earnings power.

Current EBITDA estimates for the venue range between $50 million and $100 million, but within a couple of years, this could be closer to $300 million or more. This includes the Las Vegas venue and potential licensing rights.

Using a multiple like that of live entertainment competitor Live Nation Entertainment, Inc. (NYSE: LYV) would put the stock at more than two times its current value.

Finally, the controlling shareholder—CEO Jim Dolan—recently made major open-market share purchases. This is a highly unusual action by him and indicates his confidence in the venue's operating profitability and potential for future licensing.

How is the company doing?

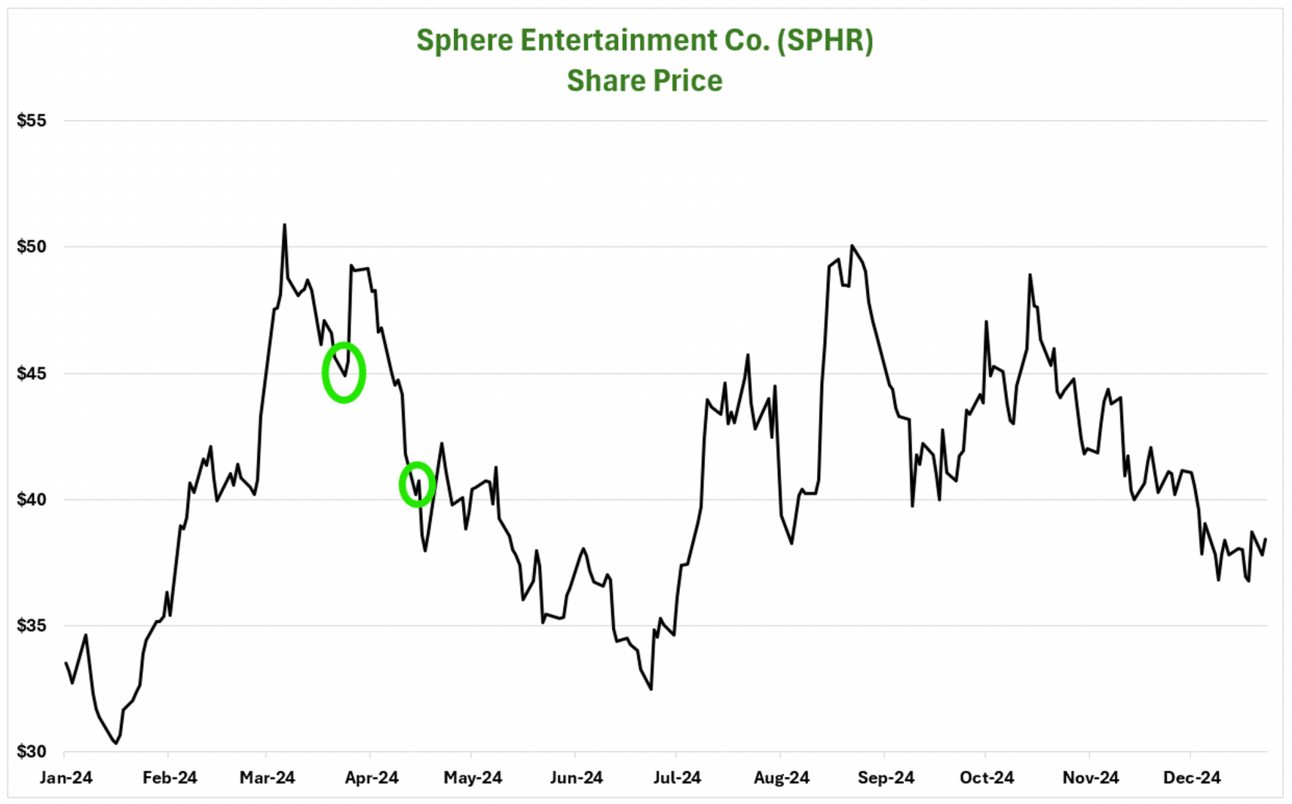

Good. We recommended the stock on March 26, and they reported earnings on May 10, August 14, and November 12.

With the initial ramp-up of the venue, they have seen reasonable volatility in these reports. This makes sense as it is still very early days for the company.

The first report disappointed around some seasonality, while the second report showed good momentum.

This most recent report continued to be “noisy.” The stock fell as much as -12% on the day of the report as they reported $228 million of revenue versus the analyst estimate of $244 million.

The challenge for the company has been the ramp-up and sustainability of their "Sphere Experience." They run this program several times daily when not hosting a major show.

Attendance to this experience is key to their profitability and – after a strong start – they have been losing some momentum on attendance. This is a concern in the short term, but we have confidence they will eventually figure it out.

Our fundamental belief in the unique nature of the asset drives this. Remember, this investment is about BOTH asset value and growth.

During the quarter, there was an announcement that the next Sphere would be built in Abu Dhabi. This will be done via a licensing deal, so it should be pretty profitable. Few details were available, so it had minimal impact on the stock during the quarter.

It does, however, begin to prove the larger thesis.

Finally, there has been some progress on negotiations with lenders around the MSG Networks sports cable TV business. Per our original report, this will not significantly affect the company's value, given that the debt is ultimately non-recourse.

How is the stock doing?

Fine. We are -13% on our position after being +13% when we wrote our last update.

As we said earlier, the stock took a tumble right after we initiated our position, and we added it to it on the weakness.

The stock has been trading between $35 and $50 per share and is now closer to the bottom of the range. We like it a lot down here.

The stock could be worth $100+, so we are happy to own it at around $50.

What is our overall view?

Nothing has changed. We like it as much as we did the day we recommended it.

We have a nice combination of asset value and growth here.

The report will be a testament to the thesis every quarter, and the stock will eventually grind higher with these reports.

We would aggressively buy the stock at current levels if you don't own it.

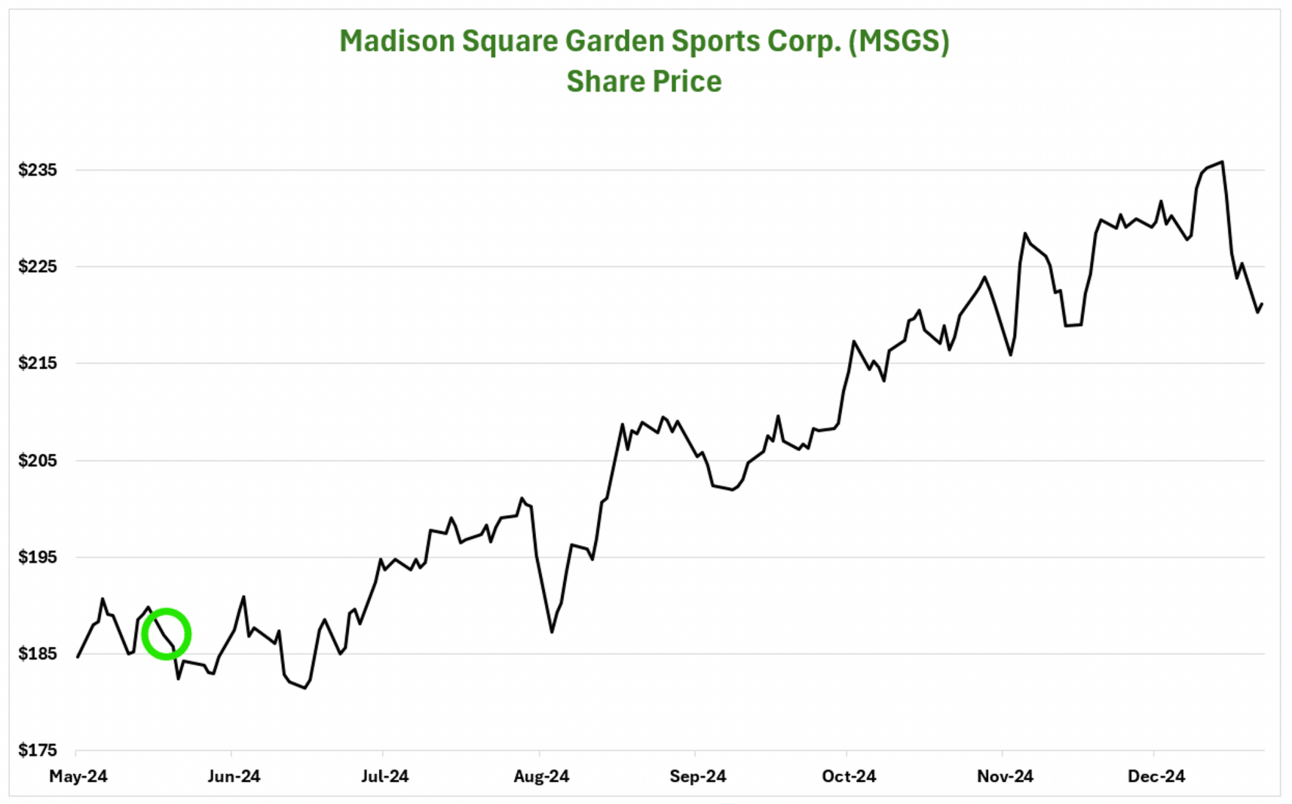

Madison Square Garden Sports Corp. (NYSE: MSGS) – Reference Date 5/17/24 – Return +17%

What does the company do?

The company owns two of the most valuable sports franchises in the world: the New York Knicks (NBA) and the New York Rangers (NHL). It also owns several minor league teams related to these franchises.

Why do we like it?

Asset Value.

This investment is basically identical to our previously discussed investment in BATRK.

We will repeat what we said above…

“We believe owning professional sports franchises is one of the best risk/reward opportunities we have seen in our thirty-year investing career.

No franchise has sold below the prior sale price in half a century. Very few (20%?) have sold around the estimated value; the rest have sold at +20% to +300% premiums.

MSGS is in a different position from an ownership perspective. While Liberty Media (owner of the Braves) is an active manager of its corporate portfolio and has sold assets in the past, the Dolan family, which controls MSGS, is much less active. There is no indication that they are looking to or are interested in selling anytime soon.

The difference here is the VALUE of these franchises.

The Braves are a great franchise; Forbes's most recent valuation for the team is $2.8 billion, making it the 8th most valuable franchise in Major League Baseball (MLB).

The Knicks are the second-most valuable franchise in the National Basketball Association (NBA), at $6.6 billion, and the Rangers are the second-most valuable franchise in the National Hockey League (NHL), at $2.65 billion.

This is also NEW YORK. We think any interested buyer would be willing to pay a much higher premium. In fact, an eventual buyer will pay the most significant premium EVER once these franchises are sold.

How is the company doing?

The same as BATRK - Fine.

Again, this is a VERY different type of investment than almost any other stock we recommend. Investors pay little attention to the revenue and earnings.

They have reported three times since we recommended the shares - May 2, August 13, and November 1.

Six analysts cover the stock, so there are no detailed estimates for the company. Both quarterly results have been fine.

The financial results are irrelevant to the thesis if no disastrous event exists.

It took the Knicks a while to get the team together after many off-season changes, but they have put it together since then. They are one of the stronger teams in the NBA.

The Rangers got off to one of the best starts in the NHL but have since completely fallen apart. I am a Rangers fan, so this sucks, but neither of these groups of results makes any real difference for the stock.

There are some concerns about restructuring at their TV partner, Madison Square Garden Network, but if those rights were to trade in the open market, they would sell for more and not less than the current deal.

In discussing the Braves above, we discussed the value of sports team valuations and recent data points.

As a company, MSGS is in great shape.

How is the stock doing?

We are up nicely (+17%) from our entry point.

Usually, the stock trades poorly over the offseason. This year, it traded well over the summer and has continued its strength into year-end.

We expect this stock to trade in a +/- 15% range until one day we wake up and make +50% or more.

What is our overall view?

We LOVE this idea. These sports franchises are the best risk/rewards we have ever seen in our careers.

We have a full 5% position but would add aggressively on any market-related weakness.

NU Holdings Ltd. (NYSE: NU) – Reference Date 5/24/24 – Return -12%

What does the company do?

Nubank is a 100% online banking platform operating in Latin America. It offers traditional banking services and other financial services such as credit cards and insurance. It serves over 100 million customers across Brazil, Mexico, and Colombia.

Why do we like it?

Growth.

The company has built an awesome asset-light model, attacking a huge market (500 million+) and competing against legacy competition with high costs and high margins.

Think of what Amazon did against legacy brick-and-mortar retailers across the last twenty-five years.

The fact that the banking industry in Latin America is uniquely poorly positioned works in favor of Nu. As we said above, it has BOTH high costs and high margins.

This allows Nu to take significant market share through pricing yet still have decent margins. Nu's first advantage is its costs are much lower than its legacy competitors. Its second advantage is that those legacy competitors have terrible customer service.

All of this has resulted in tremendous growth at the company, and if this growth continues – the stock will perform very well.

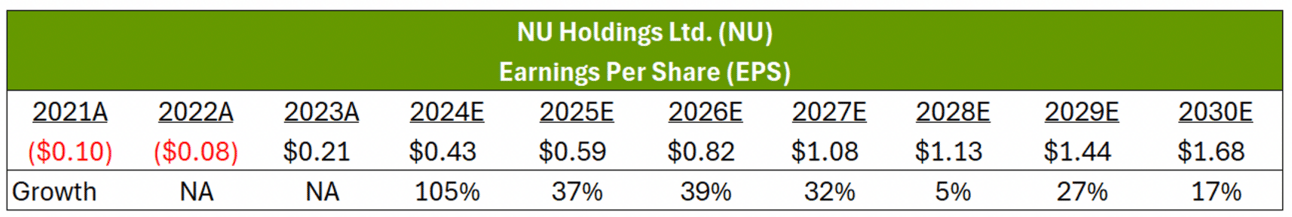

Here is a table showing their EPS growth since coming public a few years ago and current expectations going forward…

If they hit these numbers, we think the stock has a +100% upside or more.

Since we first recommended the shares in May, the later year numbers here (2027 and beyond) have moved about +10% higher.

As we said before, we think these numbers are low. Like Amazon, they will eventually add additional products to their customer base, and their revenue opportunity is massive.

How is the company doing?

Good. The company has reported twice since our recommendation – on August 13 and November 13.

They beat the earnings estimates nicely for both quarters.

The most recent quarter was almost identical to the previous quarter. They reported accelerating growth in many metrics and beat revenue and earnings estimates. There were some mild concerns about some of their loan provisioning, but the quarter was almost all positive.

The situation regarding the operations of the company also remains the same. Earnings revisions continue to move higher.

Here is that chart…

The company continues to execute well. If they continue this momentum, the numbers will increase, and the stock will follow.

How is the stock doing?

Not good recently!

This has been one of our most interesting situations in recent weeks.

On the back of the positive operating momentum, the stock hit a new all-time high on November 12 of almost $16 per share. Since then, the stock has fallen by -35%.

What has happened?

Surprisingly - nothing at the company.

In this case, the stock is another company that the waves of the Trump re-election have hit. In particular, there is the threat to use tariffs as part of his economic policy.

This concern has rocked markets that export to the United States recently.

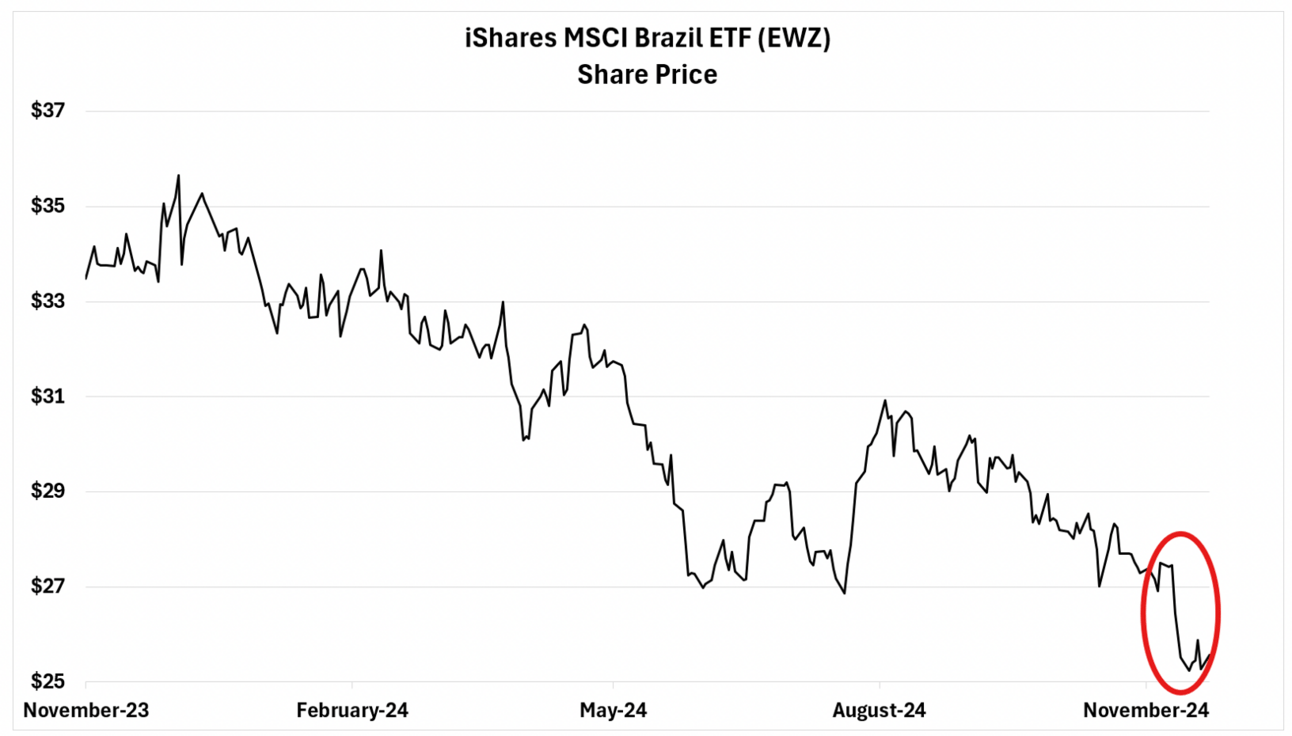

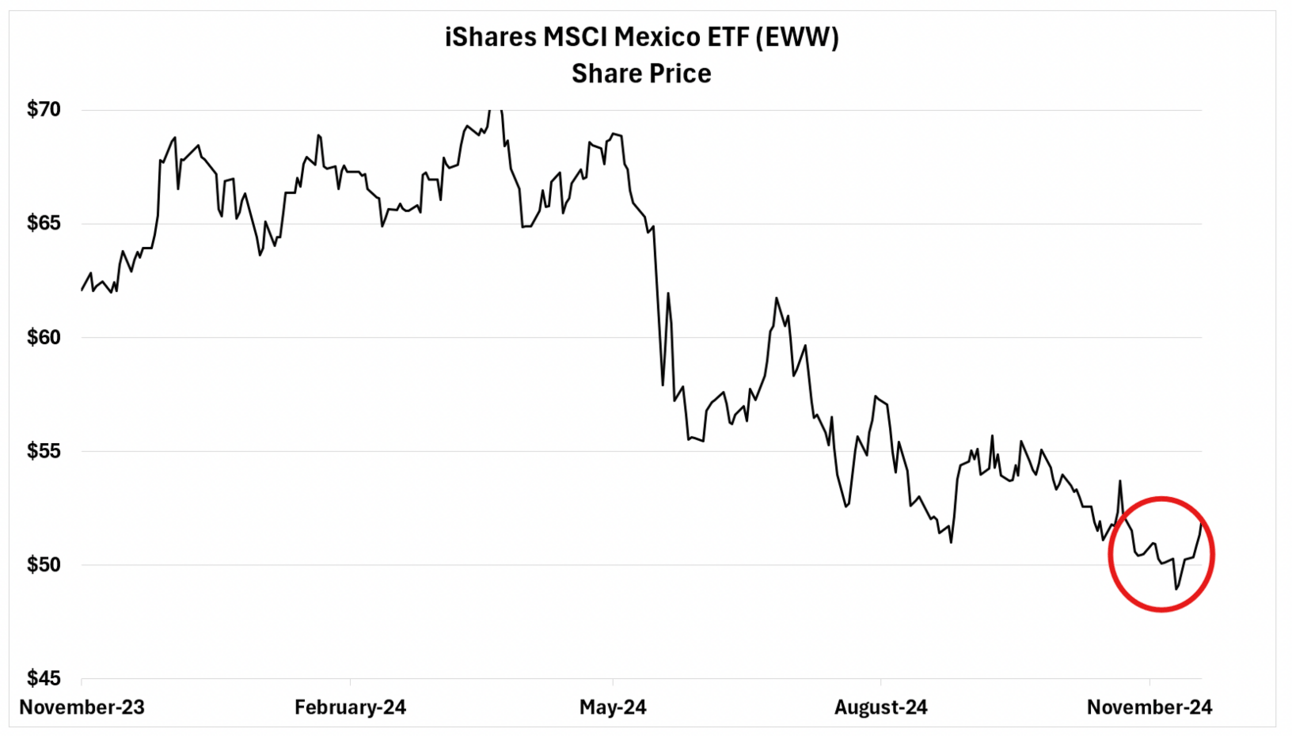

Here are the price charts for the Brazil and Mexico ETFs…

On the chart, we have circled the recent sell-offs in those markets. These are the exact same times the sell-off in NU shares began.

The question is, will these tariffs have a tangible impact on NU?

We don’t think so.

It will be some time before we know if the tariffs are implemented, how big they are, and what their impact is on these markets.

NU's biggest market is Brazil, with 90% of its customers, and US exports make up only about 1% of Brazilian GDP. It is illogical to think that the tariffs could hit the Brazilian economy so hard that it would impact NU customers.

We think the stock has been hit hard and will bounce back.

What is our overall view?

We love this position. It is our favorite GROWTH idea right now, and we think the stock could double in the next year.

We believe the recent weakness is a tremendous BUYING opportunity.

As a result, we are formally recommending that readers add to their position. This is our FAVORITE IDEA amongst our current positions.

ACTION TO TAKE: Buy another 1.5% in NU Holdings Ltd. (NYSE: NU) up to $11.50 per share.

Liberty Media Corp-Liberty Formula One (NASDAQ: FWONK) – Reference Date 5/30/24 – Return +29%

What does the company do?

The company owns Formula One (via a 100-year lease), the global auto racing competition. It organizes and holds 24 annual races globally from March to November. The company also owns a number of smaller assets and is acquiring Moto GP, the largest global motorcycle racing competition.

Why do we like it?

Asset Value and Growth.

Looking through our recommendations, you can see that we are big fans of the sports business. The opportunity to own a sports franchise is a unique risk/reward unlike anything else in the stock market.

FWONK is the opportunity to own the entire LEAGUE.

US-based investors may need to become more familiar with Formula One, but it is a global phenomenon. It reaches an international audience of over 1.5 billion people, more than double the NBA's and ten times the audience of NASCAR.

It is a unique franchise.

Under the ownership of legendary investor John Malone, they also have seen a massive expansion in growth. Here is a table showing their revenue growth along with projections…

Under Malone, they have doubled revenue in the last few years, and this is post-COVID.

We can summarize our enthusiasm for the stock in one analysis.

Right now, the global TV rights for Formula One produce roughly $1 billion in annual revenue.

The NBA is finalizing a US deal that would pay them almost $7 billion PER YEAR.

We are not arguing that Formula One should receive that amount, but given their audience and fan base, there is much upside to the current $1 billion. These incremental dollars would be 100% margin.

All we need is one of the technology giants to come in and offer to buy these rights. Amazon pays $1.8 billion annually for just a fraction of the US NBA rights. Why wouldn’t they offer that for the global rights to Formula One?

That alone could double the stock.

How is the company doing?

FWONK has much more extensive operations than our other sports-related recommendations, but like them, the near-term fundamentals are a minor driver for the stock.

The stock will perform if the numbers are generally in line and grow over time.

They have reported two quarters since we recommended the stock. Both quarters have been strong and uneventful.

However, the company continues to face pressure from regulatory agencies in both the United States and Europe.

Our last report mentioned that the Justice Department was probing how they award new teams. We weren't worried about that inquiry, and Formula One recently announced a new team that may solve the problem.

A few weeks ago, though, the European Union did open up an inquiry into their acquisition of the Moto GP motorcycle racing circuit. Not closing this transaction would be a mild negative for the company, but we don't think it would impact the shares too much.

We also think that the deal is likely to get done eventually.

With this kind of scale, the company has built these kinds of inquiries that are always going to be an issue. We think the company can navigate them, and they do not ultimately impact the value proposition of better monetizing their broadcasting rights.

Away from the company, over the last few months, we have seen Netflix, Inc. (NASDAQ: NFLX) become quite aggressive in sports broadcasting.

First, with the Mike Tyson versus Jake Paul fight, and now with the live NFL broadcasts they will be doing on Christmas day. They have also announced that they are acquiring exclusive rights to the FIFA Women's World Cup.

We think one of the major streaming companies will eventually come to Formula One and cut a deal that could double (or more) their total profitability.

How is the stock doing?

Great. The stock has been +29% since our recommendation and has hit a new all-time high in the last few weeks.

Despite no significant changes in the numbers and the continuing regulatory inquiries, the shares continue to march higher.

We think that in 2025 we will be seeing rumors and/or an announcement about a global rights deal. We believe the stock could double (or more) on this news.

What is our overall view?

In the last update, we said this was our favorite stock, along with TLN and NU. The stock followed through on that promise.

It remains a great combination of asset value and growth and could be our best stock of 2025!

BellRing Brands, Inc. (NASDAQ: BRBR) – Reference Date 7/3/24 – Return +30%

What does the company do?

BellRing is a food company that sells and markets nutrition products such as Premier Protein, Dymatize, and PowerBar through food, drug, mass, club, specialty, e-commerce, and food service channels.

Why do we like it?

Growth.

BellRing is a simple story. They own high-quality brands that are focused on nutrition and protein.

They fit well with the movement towards health consciousness among consumers. They also address one of the challenges of the GLP-1 weight loss drug phenomenon, the ability of users to get enough protein in their diet.

They have exhibited significant growth on the back of their brands and the strong trends in their categories.

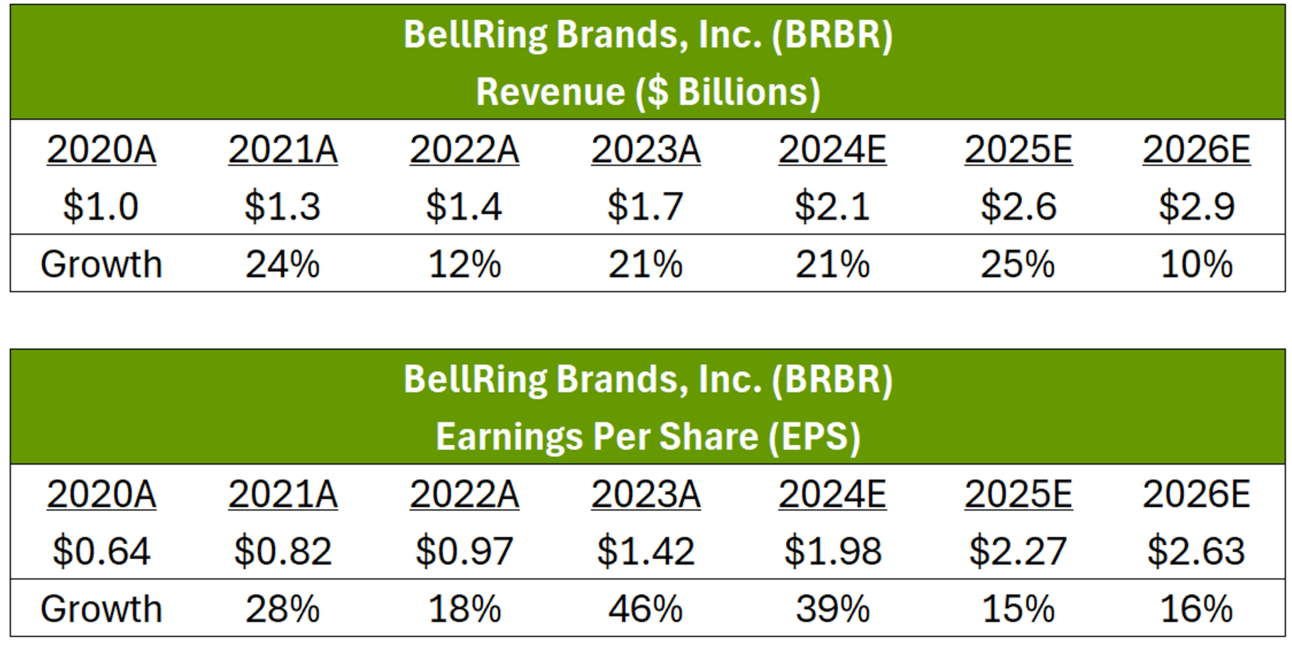

Here are the tables showing their revenue and earnings growth over the last few years and analyst estimates for the future…

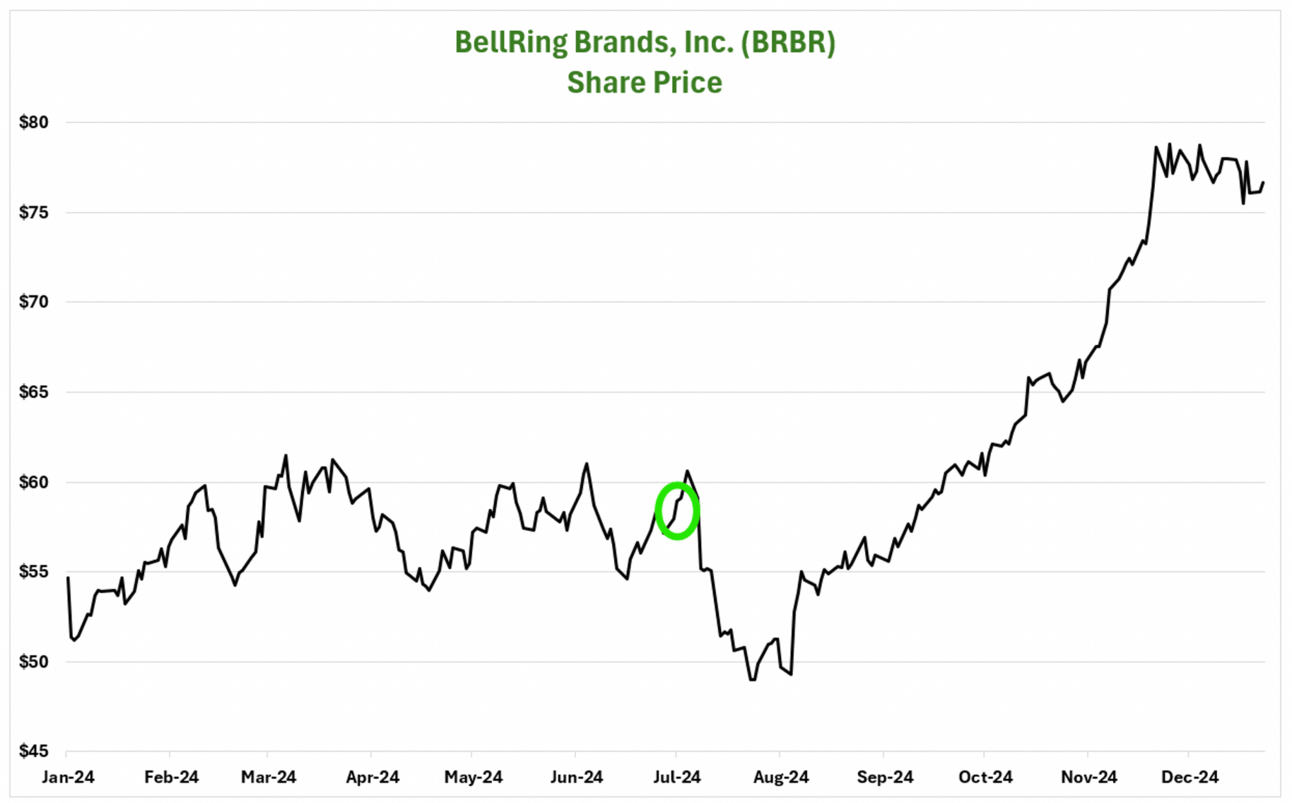

The company has excellent operating momentum and has been beating numbers along with robust growth. Here is the chart showing analyst estimates for EPS for this year…

Chairman Bill Stiritz also has an outstanding thirty-plus-year record of creating tremendous shareholder value.

Excellent product, great trends, excellent operational execution, and a legendary investor.

According to the analysts ' expectations, the stock will rise much higher if the company meets the numbers (and continues to beat them).

How is the company doing?

Great. Since we recommended the stock on July 3, the company has reported two impressive quarters.

For the most recent quarter in mid-November, the company reported revenue of $556 million versus analyst estimates of $536 million. They also beat on EPS as they reported $0.51 versus consensus of $0.50. Growth in sales volume also remained strong at +19%.

As usual, the company also continued to raise guidance. They took fiscal 2025 revenue guidance to a midpoint of $2.28 billion versus analyst consensus of $2.22 billion. EBITDA guidance was also raised to a mid-point of $475 million versus the consensus of $468 million.

The key to the BRBR story is continued earnings momentum, and the company continues to execute.

How is the stock doing?

Great! The stock was down despite the strong quarter when we did our last update. With another strong quarter, the stock has now rallied nicely.

In the last update, we had to explain why the stock had not done much despite a strong quarter.

We explained that with growth stocks like BRBR – which also have relatively high valuations – it can take time.

The key is to see them continue to grow and beat numbers. If they accomplish these goals, the stock will continue grinding higher.

That is precisely what happened and what we think is likely to continue to occur in the future.

We remain confident in the stock.

What is our overall view?

We continue to like the stock, and our thesis is simple – good products, great trends, excellent operational momentum, and a legendary investor.

If they hit the numbers, it goes (a lot) higher. If they don’t, we sell.

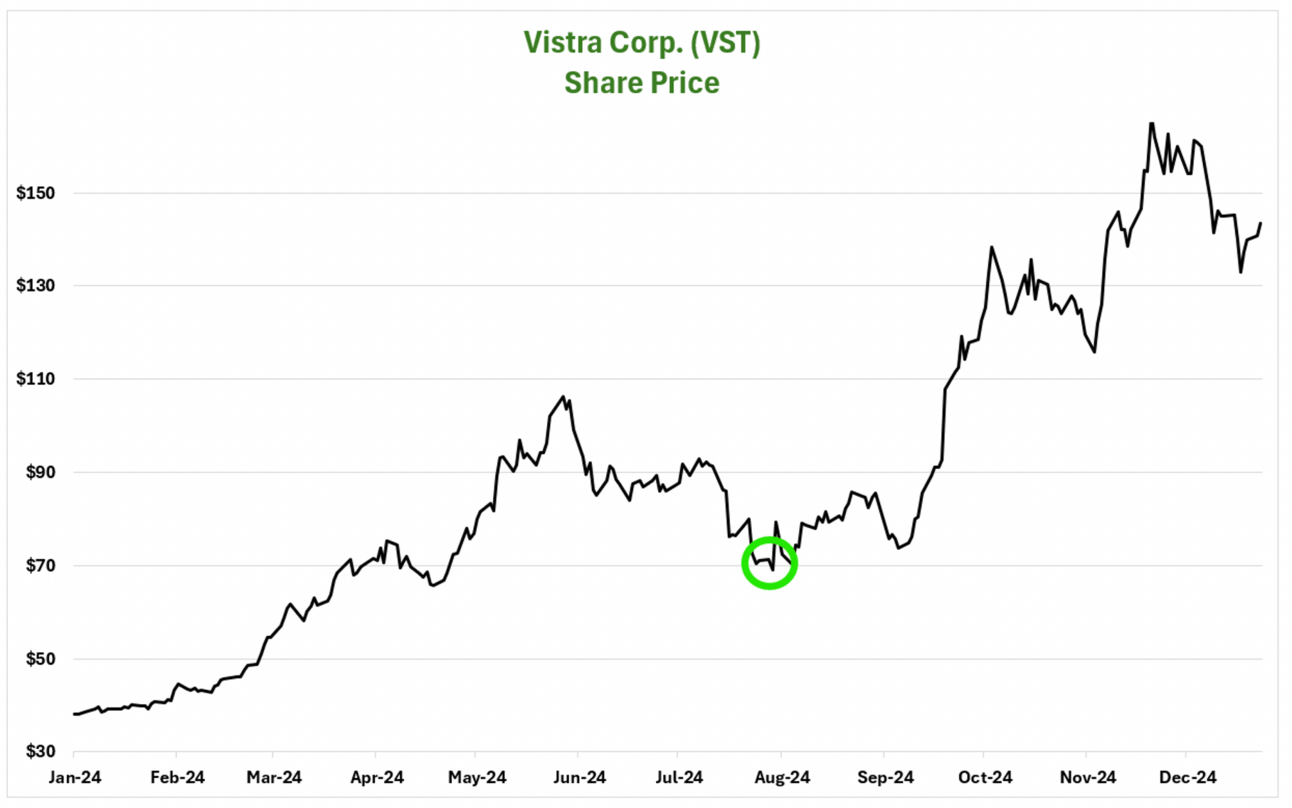

Vistra Corp. (NYSE: VST) – Reference Date 8/5/24 – Return +105%

What does the company do?

Vistra is the largest owner of competitive power generation in the United States, with a capacity of 41,000 megawatts. Its fleet includes various energy sources, including natural gas, coal, solar, and nuclear. The company owns assets that were formerly part of TXU Energy and Dynegy.

Why do we like it?

VST is the same thesis as TLN but with a slightly different monetization method.

The thesis is that we need more current or new power to meet growing demand, especially with data centers and AI growth.

Competitive power prices will move much higher in the next few years as this plays out in the market.

Eventually, new supply will enter the market, but that process will take a long time, given (mostly) political and economic constraints.

During that period, the companies that own unencumbered power generation assets will make substantial money.

While those earnings may or may not be sustainable, we trust management to use that cash economically positively.

Either they will build additional generation (for which they are ideally positioned) or return capital to shareholders.

VST has repurchased 20% of its shares in the last two years.

As the largest owner of competitive generation, VST will be the primary beneficiary of this situation.

How is the company doing?

Great. We recommended the stock on August 5, and they reported great numbers on August 8. They reported even better numbers on November 7.

They reported EBITDA of $1.44 billion versus the analyst consensus of $1.37 billion and raised the mid-point of 2024 EBITDA guidance to $5.1 billion from $4.8 billion. They also initiated 2025 EBITDA guidance of $5.8 billion compared to analyst estimates of $5.45 billion. These are all the mid-points of the range.

Additionally, they announced they were adding another $1 billion to their pre-existing share buyback authorization of $1.5 billion through year-end 2026. This brings their total capacity to $2.5 billion over the next two years, or 5% of their current market capitalization.

Based on previous management actions, we suspect this number will be two to three times that in the next few years.

The company shares a similar thesis to TLN and continues to blow away numbers.

How is the stock doing?

Incredible! Our timing was great as we are up +105% on the position in just three months. That doesn’t happen very often…

Our timing wasn’t an accident. Here is what we shared in our last update…

“Given our long-term outlook, we don't focus on short-term price and entry points in HX Legacy, but we don't ignore them.

We sold almost everything in our trading products on July 17. VST had begun to pull back prior to that, and we had decided we wanted to own it, but we chose to wait for our entry point.

We bought it on Monday when the VIX hit its third-highest level ever! Our timing was excellent…”

We had no idea it would be THIS good!

Sitting on a double in just a few months leaves us somewhat anxious as the stock could easily pull back double digits from these levels and still be on its long-term uptrend.

That being said, we think the REAL power crisis in this country has not even begun yet. When it does, the earnings at VST (and TLN) could go up +50% to +100% from these levels.

When that happens, we think the stocks will follow.

What is our overall view?

We continue to like the stock for the long term. If you do not own it, we would buy some and buy more on a pullback.

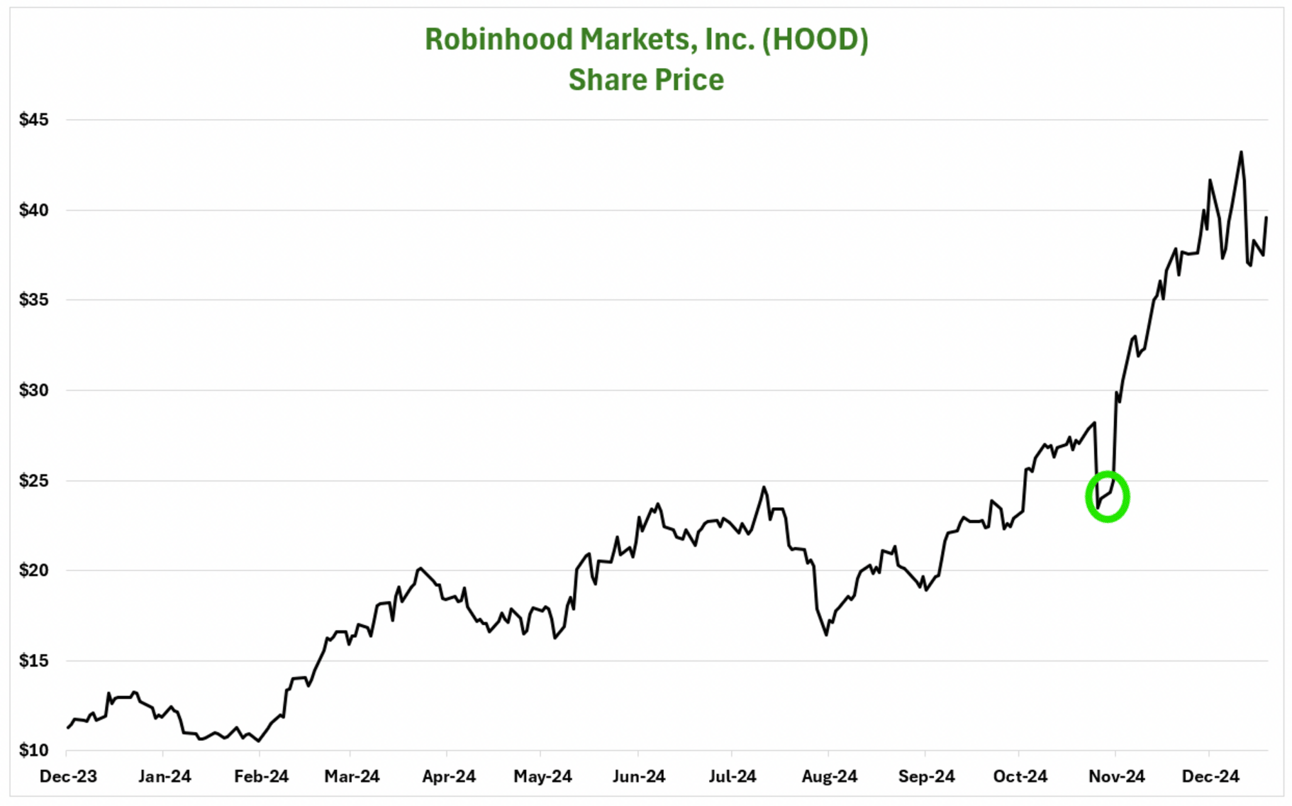

Robinhood Markets Inc. (NASDAQ: HOOD) – Reference Date 8/5/24 – Return +55%

What does the company do?

The company is a financial services platform offering brokerage and other services across a range of assets, including stocks, ETFs, options, and cryptocurrency. They are a leading next-generation online platform characterized by low cost and ease of use for the consumer.

Why do we like it?

We think HOOD is one of the most misunderstood companies in the stock market.

Most investors think of HOOD as the equivalent of an online casino where young traders can speculate on meme stocks, short-term options, and cryptocurrencies.

While they do have young customers, and you can do all of those on the platform, we see HOOD as attempting to replicate the success of Amazon.com, Inc. (NASDAQ: AMZN) and Meta Platforms, Inc. (NASDAQ: META) in the financial services industry.

Like AMZN, they began by focusing on a relatively small market – low-cost, mobile-focused equity trading. They quickly added more products (especially options and crypto) and today have a well-diversified set of products addressing many financial needs.

Their low costs and ease of platform use have led to more than 24 million Americans opening an account on the platform. That is roughly 10% of the total addressable market for adults in the United States.

Their $140 billion in assets, though, is only 0.3% of the $65 trillion in total financial assets in the United States. Their goal now is to close the gap between these two numbers.

Like AMZN, they have built a platform that can serve a large total addressable market ("TAM") and have a significant cost advantage over competitors. Now they are going to take market share.

Like META, they have created a platform with algorithms to encourage usage. Like it or hate it, the platform combines usability with engagement. It is also basically free. They sometimes even pay you to use it. Sound familiar?

We think that most investors are blinded to the potential at HOOD by the controversy in their history. We believe, however, that they are sitting on a huge opportunity.

One last reason we like it is that they are among the largest holders of Bitcoin out there. They don't own it directly, but if Bitcoin appreciates like we think it will (target price of $1,000,000), they will see massive asset growth.

HOOD is very similar to NU in many ways, but it has a higher growth opportunity here in the United States and exposure to cryptocurrency.

How is the company doing?

We recommended the shares after the company had reported another strong quarter but had sold off.

The company is growing rapidly. Revenue is on pace to grow by +46% year-over-year. They will also post $0.87 of EPS versus losing money in 2023.

The company has also been beating numbers. While the most recent quarter was “noisy,” they had beaten the previous three quarters on revenue, EBITDA, and EPS.

Their results can be volatile, given the underlying volatility of their markets, so investors will need to be patient.

We prefer to look at the intermediate-term trends, and the company has been executing well on that level.

They also are rapidly growing their asset base as assets under custody have grown to $152 billion or +76% year-over-year. With the company rapidly expanding its products, we expect the growth to continue.

Finally, we love the HOOD story on a standalone basis, but we especially like the exposure to cryptocurrency.

We think 2025 will see even more strength in Bitcoin, and HOOD will be a beneficiary.

How is the stock doing?

Great! We recommended the stock on November 5, and it's up a fantastic +55% since our recommendation!

Like the timing of our recent recommendation of VST, this is no accident.

For our recent recommendations with HX Legacy, we have focused on high-growth companies that have also been great stocks. We have then been looking to take advantage of volatility.

In the case of HOOD, we waited to get the quarter out of the way and purposefully waited until RIGHT before the election before making the recommendation.

This timing has worked out well.

We won’t always be able to have this kind of timing, but it is one of the value-added aspects of our service.

What is our overall view?

We think they could pull back quickly with the recent rapid rise in the shares. We would be aggressive buyers on any significant pullback towards the 100-day moving average.

For the long term, we think the stock has the opportunity to double or triple.

We hope you enjoyed our third quarterly review of our INVESTING publication, HX Legacy.

Again, we are looking for high-return positions (at least double) and have been looking to own them for a long time. This also means that we are tolerant of some level of volatility.

We are pleased with our first six months of performance, as the INVESTING methodology we have developed over three decades demonstrates its capabilities.

TRUST THE PROCESS.

As always, hit us with any questions in the comments section of this note, and you can also email us at [email protected].

We appreciate your support!